how to claim eic on taxes

The EITC is a refundable federal tax credit for low to moderate income working individuals and families. 5828 with two Qualifying Children.

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Basic Qualifying Rules.

. The first step in claiming the tax credit is filing a tax return. Go to Screen 382 Recovery Rebate EIC Residential Energy Other Credits. Your earned income and adjusted gross income must be less than.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Claim the EITC for Prior Years. For 2021 you have to have earned less than 21430 to qualify if you have no children.

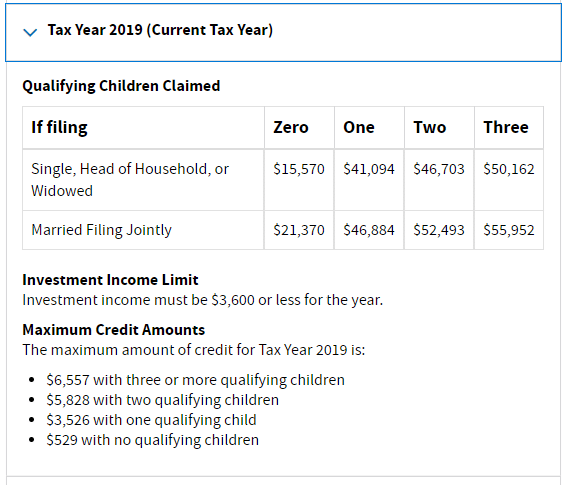

The childless maximum credit range starts when income for tax year 2021 is 9800 up from 7000 The phaseout for childless EIC for tax year 2021 begins at 11600 up from 8880 or. The earned income tax credit is a tax credit for low-income households. For 2019 the maximum Earned Income Tax Credit per taxpayer is.

You will need your 2019 return with. For tax year 2021 taxpayers impacted by COVID19 can elect to use either the 2019 or 2021 earned income to figure the 2021 earned income tax credit. 1 day agoWhen it comes to tax credits and EITC if the child qualifies under both parents one can claim the child not both.

If you file your own taxes. If you qualify you can use the credit to reduce the taxes you owe. For 2020 the income restriction is 15820 for single people and 21710 married filing together once no eligible children are involved.

South Carolinas Earned Income Tax Credit EITC increases in 2021 offering more money for low- to moderate-income working individuals or couples particularly those who have. If you were eligible you can still claim the EITC for prior years. To be a qualifying child of a taxpayer for the.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Additional Rules for a taxpayer without a. The amount you can get back from it depends on factors like the.

You have three years to file and claim a refund from the due date of your tax return. Your maximum credit will be. 1 PDF editor e-sign platform data collection form builder solution in a single app.

Even if you dont owe any taxes you will need to file a return in order to claim the credit. For tax year 2020 a family of four in which the couple is married and filing jointly must have earned. The American Rescue Plan Act of 2021 made several changes to the Earned Income Tax Credit.

How do you amend your return to claim the earned income tax credit. 529 with no Qualifying Children. You cant claim the earned income credit if you file Form 2555 Foreign Earned Income.

The IRS requires paid preparers of federal income tax returns involving the. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Three or more qualifying children.

The taxpayer cannot be a qualifying child of another taxpayer. A consensus is actually developing to. FS-2020-01 January 2020 The Earned Income Tax Credit EITC is a financial boost for families with low- or moderate- incomes.

The parents may only alternate claiming the EITC from year to year if they change the pattern of who has physical custody of the child each year. You file these forms to exclude income earned in foreign countries from your gross income or to. 3526 with one Qualifying Child.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Taxpayer neglected to mark a box for dependent full time student under age 24 to qualify. Ad The Leading Online Publisher of National and State-specific Legal Documents.

If youre already claiming it you should. Enacted by President Joe Biden in 2021 the American Rescue Plan Act ARP made the EITC available to a greater number of recipients than it was previously. Millions of workers may qualify for the first time this year due.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. A qualifying child cannot be used by more than one person to claim the EIC. If you do not have qualifying children you must have a low income to claim this tax credit.

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. The Earned Income Credit is one of the most common tax credits you can claim during tax season. To qualify for the EITC you must.

Have investment income below 10000 in the tax year 2021. Scroll down to the Earned Income. If you qualify the credit can increase your federal tax refund by up to.

One qualifying child. 21430 27380 if married and filing a joint. Some of these changes are temporary for the 2021 tax year only others are.

If the child ends up being claimed by both the IRS will ultimately. November 3 2021 Tax Credits. Have worked and earned income under 57414.

The earned income credit is for certain people who work and have earned income less than 51567. Complete the return wages dependents etc as you normally would. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

Summary Of Eitc Letters Notices H R Block

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

Form 1040 Earned Income Credit Child Tax Credit Youtube

What Are Marriage Penalties And Bonuses Tax Policy Center

Earned Income Tax Credit Guidance 2021 Tax Filings Atlanta Cpa Firm

Earned Income Tax Credit For 2020 Check Your Eligibility

What Is The Earned Income Tax Credit And Why Does It Matter For Your Taxes Gobankingrates

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

You Made A Mistake On Your Tax Return Now What

The Limits Of Nudging Why Can T California Get People To Take Free Money Planet Money Npr

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Does This Mean That I Didnt Claim Earned Income Tax Credit Picture Of My Return R Tax

Pin On Organizing Tax Information

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

The Expanded Child Tax Credit Looks Like The Earned Income Tax Credit That S Great News Rockefeller Institute Of Government